Fixed Income Mutual Funds: A Safe Investment Option for Indian Investors

file your ITR hassle - Free!

Great! – With Easy Return Get Your ITR Filed in Just 1 Day at ₹399/- only…

Fixed Income Mutual Funds: A Safe Investment Option for Indian Investors

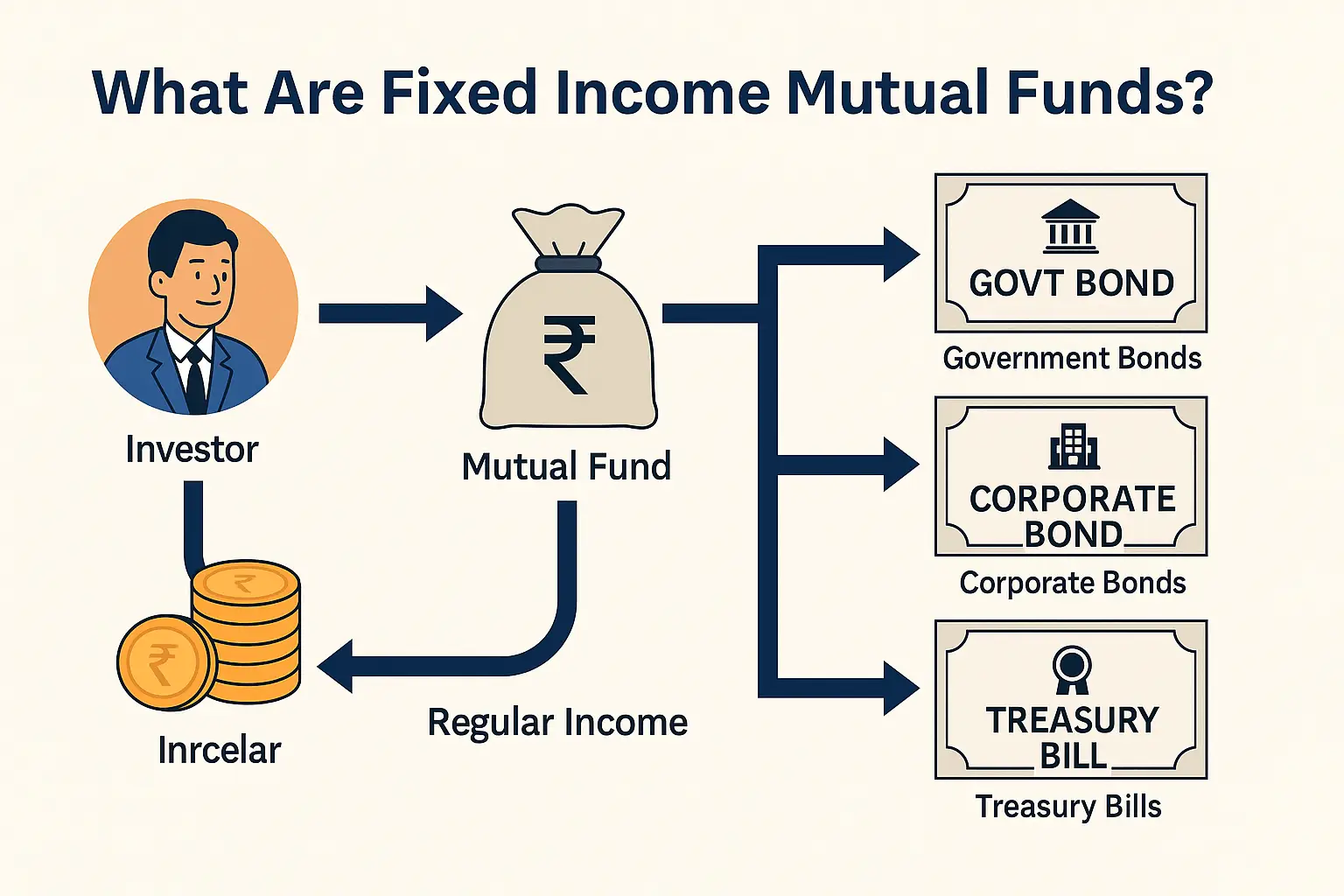

What Are Fixed Income Mutual Funds?

Fixed income mutual funds are a type of mutual fund that mainly invest your money in debt instruments like government bonds, corporate bonds, treasury bills, and other fixed-income securities.

When you invest in these funds, you’re indirectly lending your money to reliable institutions—like the government or reputed companies such as LIC, SBI, or Tata. In return, they pay regular interest.

Think of it like this:

Imagine you pool your money with thousands of other investors. A professional fund manager then uses that large sum to invest in safe, interest-paying securities. The returns you earn are mostly from:

Interest income

Gains from selling bonds (if prices go up)

These funds are meant for investors who want:

✅ Steady and regular income

✅ Safety of their principal

✅ Lower risk than equity mutual funds

Why Should You Consider Fixed Income Mutual Funds?

They are ideal for conservative investors

You don’t need to track the stock market

You get professional management

More tax-efficient than Fixed Deposits in some cases (especially with indexation)

How Much Money Is Invested in These Funds?

According to the Association of Mutual Funds in India (AMFI), Indian investors have invested over ₹13 lakh crore in fixed income mutual funds (as of 2023). This proves how much trust Indian savers place in these funds for generating stable income.

file your ITR hassle - Free!

Great! – With Easy Return Get Your ITR Filed in Just 1 Day at ₹399/- only…

Best Fixed Income Mutual Funds in India

The “best” fund will depend on your goals, but while choosing a fund, always check:

Fund performance (returns over 3-5 years)

Credit quality of the bonds in the portfolio

Duration risk (short-term vs long-term funds)

Expense ratio (how much fee is charged annually)

Top-performing categories (as of FY 2024-25) include:

Liquid Funds (for short-term)

Corporate Bond Funds (for moderate returns)

Gilt Funds (for safety with government securities)

Banking & PSU Funds (safe and stable returns)

What Kind of Returns Do Fixed Income Mutual Funds Offer?

1. Interest Income

This is the regular return generated by bonds. For example, if a corporate bond offers 7% interest and your fund holds ₹1 lakh worth of that bond, the fund earns ₹7,000 per year.

2. Capital Gains

If the fund buys a bond at ₹100 and later sells it for ₹105, the ₹5 profit is added to your returns.

3. NAV Appreciation

As the total value of the fund’s investments increases, the Net Asset Value (NAV) also grows.

Example:

If you invest ₹10,000 and the fund earns 6.5% from interest + 1.5% from NAV growth, your ₹10,000 becomes ₹10,800 in one year.

Best Support Service - ever!

Easy Return Gives The Best Support Service To You, While Filing Your Income TAX Return’s.

Categories of Fixed Income Mutual Funds

Fixed income funds are divided based on the maturity period and type of securities they invest in:

| Category | Investment Duration | Suitable For |

|---|---|---|

| Overnight Funds | 1 day | Parking idle cash |

| Liquid Funds | Up to 91 days | Short-term savings |

| Ultra Short Duration Funds | 3-6 months | Emergency fund alternative |

| Low Duration Funds | 6-12 months | Lower risk with slightly better returns |

| Money Market Funds | Up to 1 year | Moderate returns with high liquidity |

| Short Duration Funds | 1-3 years | Slightly higher returns than FDs |

| Medium Duration Funds | 3-4 years | Balanced risk-return |

| Medium to Long Duration | 4-7 years | For medium-term financial goals |

| Long Duration Funds | 7+ years | High return potential, but sensitive to interest rate changes |

| Dynamic Bond Funds | No fixed duration | Fund manager adjusts duration based on market |

| Corporate Bond Funds | Invest in top-rated corporate bonds | Higher return than government securities |

| Credit Risk Funds | Invest in lower-rated corporate bonds | Higher returns but higher risk |

| Banking & PSU Funds | Invest in banks, PSUs | Good balance of safety and return |

| Gilt Funds | Government securities only | No credit risk |

| Gilt with 10-Year Duration | Fixed 10-year government bonds | Predictable long-term return |

| Floater Funds | Bonds with floating interest rates | Adjust returns with market trends |

Key Benefits of Fixed Income Mutual Funds

Regular Income: Interest earned is distributed regularly (monthly or quarterly).

Capital Preservation: Designed to protect your investment amount.

Diversification: Funds invest in many bonds, reducing risk from any one company.

Professional Fund Management: Managed by experts who study markets daily.

Liquidity: You can withdraw your money anytime (except in closed-end funds).

Tax Efficiency: Long-term gains (after 3 years) get indexation benefit.

📣 Are You Ready to File Your ITR?

- Visit Easy Return today.

- Get expert assistance suited to your investment needs.

- Ensure accurate & timely tax filing with our trusted services.

Risks Involved in Fixed Income Mutual Funds

Even though these funds are safer than equity, some risks still exist:

Interest Rate Risk: Bond prices fall when interest rates rise.

Credit Risk: If a company defaults on the bond payment, it affects returns.

Inflation Risk: If inflation is higher than your return, real gains are negative.

Tax on Short-Term Gains: Gains under 3 years are taxed as per your income slab.

Low Growth: These funds are not meant for wealth creation. They are for capital protection.

Tips Before Investing in Fixed Income Mutual Funds

Know Your Goal: Are you saving for a short-term need or looking for passive income?

Check Fund’s Past Performance: Look at 3- and 5-year return trends.

Understand Risk Levels: Some fixed income funds take higher risk to offer better returns.

Look at Expense Ratio: Lower cost means higher returns for you.

Fund Manager Experience: Check how experienced the fund manager is.

Tax Treatment: Long-term holding (3+ years) qualifies for indexation and 20% tax.

file your ITR hassle-Free!

Great! – With Easy Return Get Your ITR Filed in Just 1 Day at ₹399/- only…

Case Study: Raj’s Smart Investment Journey

Raj, a 35-year-old software engineer in Kolkata, wanted safer investments. He found fixed income mutual funds perfect for his needs. But he was unsure about how to show these in his ITR.

He contacted Easy Return, where tax experts helped him report mutual fund capital gains properly, saving tax using indexation. Today, Raj has peace of mind—his money grows steadily, and his taxes are filed accurately every year.

Fixed Income Funds vs Fixed Deposits: A Quick Comparison

| Feature | Fixed Income Funds | Fixed Deposits |

|---|---|---|

| Returns | 5–8% (market-linked) | 5–7% (fixed) |

| Liquidity | High (no lock-in) | Low (penalty on early withdrawal) |

| Tax Benefits | LTCG with indexation after 3 years | Interest fully taxable |

| Risk | Moderate | Low |

| Flexibility | Many types available | Standard across banks |

Need Help With ITR Filing?

If you’ve invested in mutual funds, filing your income tax return correctly is important.

Easy Return offers:

Expert tax filing support (₹399 only)

Mutual fund capital gain reporting

Personalized advice from professionals

Same-day ITR filing service

Conclusion

Fixed income mutual funds are an excellent choice for investors who want:

Predictable and steady income

Safety of capital

Professional fund management

If you’re not keen on the volatility of stock markets and still want better returns than savings accounts or FDs, these funds can be your go-to option.

Let Easy Return help you invest wisely and file taxes smartly.

Frequently Asked Questions (FAQs)

Yes, they are considered safer than equity funds. However, they carry some risk due to interest rate fluctuations and credit quality of bonds.

It depends on the fund category. Liquid and ultra-short duration funds are ideal for a few months, while long-duration funds suit 3-7 years investment goals.

Yes, most open-ended fixed income funds allow you to withdraw anytime. Some may charge an exit load for early withdrawal.

Yes. If you hold the investment for more than 3 years, you get indexation benefits and pay 20% tax on gains. If sold within 3 years, gains are taxed as per your income slab.

For short-term goals (up to 1 year), Liquid Funds and Ultra Short Duration Funds are ideal. They offer better returns than a savings account and are relatively low-risk.

Returns usually range between 5% and 8% per year, depending on the fund type, market interest rates, and credit quality of bonds in the portfolio.

No, most fixed income mutual funds are open-ended and don’t have a lock-in. However, some may charge an exit load if you withdraw early (e.g., within 7 days to 1 month).

Yes, fixed income funds are good for senior citizens who want regular income with low risk. They are more tax-efficient than fixed deposits for long-term holding.

Yes, you can invest monthly through a Systematic Investment Plan (SIP). This helps in disciplined saving and managing interest rate risks over time.

No, mutual funds do not deduct TDS on returns. However, you need to declare capital gains or interest income when filing your income tax return.

To invest, you need:

PAN card

Aadhaar card

A bank account with IFSC code

KYC compliance (done through any mutual fund platform or distributor)

Yes, although rare, you can lose money due to:

Rise in interest rates (which lowers bond prices)

Default by a company (in case of credit risk funds)

Exiting the fund during a market dip

That’s why it’s important to choose the right category and a well-managed fund.

Equity funds invest in shares and are suitable for high returns but come with high risk. Fixed income funds invest in debt instruments and are best for low to moderate risk with steady income.

Duration risk means the fund’s sensitivity to interest rate changes. Long duration funds are more affected when interest rates rise or fall. Short duration funds carry less duration risk.

Held < 3 years: Gains are taxed as per your income tax slab (Short-Term Capital Gains)

Held > 3 years: Gains taxed at 20% after indexation benefit (Long-Term Capital Gains)

Indexation helps adjust your investment for inflation and reduces taxable profit.

Indexation allows you to increase the purchase price of your mutual fund units based on inflation. This reduces your taxable capital gains, saving tax when you file ITR after 3 years of holding.

Yes. If you're comfortable with slightly more risk for better post-tax returns, switching from Fixed Deposit to a Fixed Income Fund is a good option, especially for long-term goals.

Corporate bond funds invest in highly rated companies (AAA or AA+). They are relatively safe, but not as risk-free as government securities. Check the fund's credit quality before investing.

No, returns are not guaranteed. They are market-linked and may vary depending on interest rates, bond performance, and fund strategy.

Yes. Easy Return provides expert ITR filing services and ensures all your mutual fund gains, losses, and dividends are correctly reported. We also help you claim indexation benefits to reduce your tax.

Fill the details , we will contact you .

CA Sagar Batra

Founder, Easy Return Inc.

Sagar Batra is a seasoned Chartered Accountant with over 10 years of experience. As the founder of Easy Return Inc., he regularly writes about important updates in India's tax system to help individuals and businesses stay compliant.